Carried Interest, Unlimited Tax Free Earnings for the Wealthy

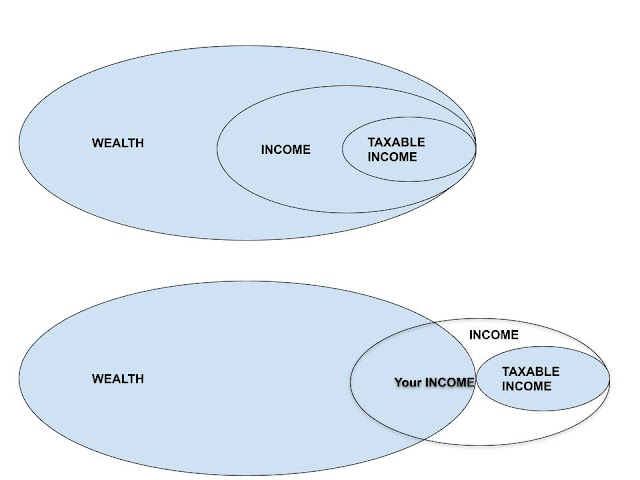

This post isn't contrarian, it just simply explains a concept many don't realize exist and those that do just know it's a giant tax loophole for the wealthy. Or maybe this applies to the viewpoint that the wealth pay their fair share. This concept is similar to the business buyout concept discussed in my previous blog post. Some Income is NOT Your WEALTH Comparing a regular person earning $1000 yearly and investing the post tax remainder, to the fund manager taking $1000 from the fund and investing it tax free. Explanation The regular person earns $1000 which we're assuming is in the 24% tax bracket. So Uncle Sam takes $240 leaving them with $760 to invest, this happens every year for 45 years giving Uncle Sam $10,800 of Regular Jane's and/or Joe's earnings. Meanwhile, Mr. Billionaire Fund Manager takes $1000 from the Fund Jane and Joe are invested in and pays no tax. Repeat 44 times. The comparison assumes a 6% annual return compounded annually. Results So...