Some Income is NOT Your WEALTH

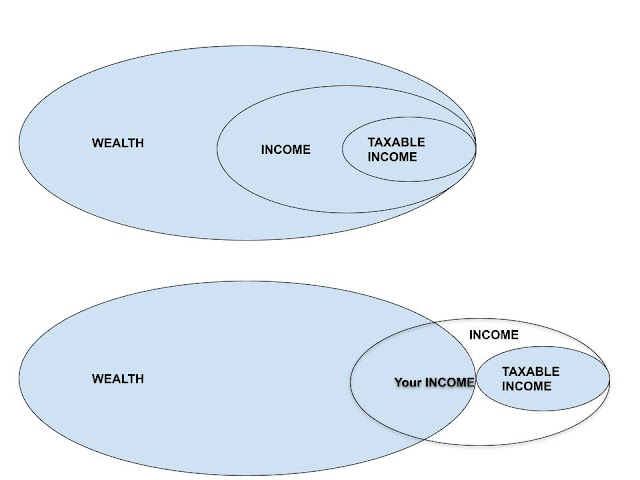

Standard Viewpoint: Your INCOME is not your wealth.

Wealth Venn Diagrams: What do you believe is correct? Top or Bottom

THE CONTRARION VIEWPOINT

YOUR Income is YOUR WEALTH!!

The discussion regarding wealth tax and/or taxing of unrealized capital gains seems to have a serious flaw. Unless you believe the bottom Wealth/Income Venn diagram to be true and correct. However, I believe most would agree your income is your wealth.

So what is going on with Income tax. It seems that several things might be true.

- The term income when discussing taxation has been cleverly used to confuse most into believing that income and wealth are separate.

- The income tax system favors certain types of income, and therefore certain types of people, mostly the wealthy stock and real estate investors.

INCOME TAX is really a WEALTH TAX that

Taxes some types of wealth transfers and not others.

TAXED to the MAX

- Paychecks are heavily taxed.

- Asset transfers between individuals and businesses are taxed.

- Business owner decides to reward employees and turn over the business. If they wait until death, potentially zero tax, do it while alive and the heir is still young, TAX to the MAX

- "UNREALIZED" capital gains in real estate are taxed by the states

UNTAXED

- Trust Funds: Transfer a bunch of wealth including "unrealized" capital gains income tax free.

- Step up in Basis: At some point those "unrealized" capital gains can be realized. But step up in basis raises the bought at price, to the date the trust fund was created, so bye, bye decades of capital gains.

- INHERITANCE: Someone died here comes an untaxed windfall

- $12.06 million in wealth, potentially mostly "unrealized" capital gains transferred tax free. Yes, we can't force some of the 2% wealthiest and their heirs to deal with the "hassle" of going through a trust to get their inheritance tax free. So the bottom $12 million of these massive fortunes must just be excluded from taxation.

- Step up in Basis: Bought @ price stepped UP to price on date of transfer. Bye, bye decades of capital gains. So heir can immediately sell the asset tax free, one that had the predecessor sold or transferred to the "heir" of their choice just days before would have potentially paid a huge tax bill.

- $11.1 million in wealth puts you in the top 1%

- Retire, leave the United States, renounce citizenship or just move to Puerto Rico, cash out and pay zero Federal income tax

- Facebook Founder Eduardo Saverin moved to Singapore, renounced US citizenship in 2011 and saved an estimated $700 million in income taxes

- Foreign investors sell US stocks at profit, tax free

- South Korea based MUST Asset Management sold 100% of Gamestop shares (4.7% of Gamestop) during short squeeze making as much as $1 billion, and paid zero income tax.

REDUCED TAX

- Capital Gains

- Carried Interest: Fund managers pay themselves in shares of the fund and only pay taxes if and when they cash out. Potentially never.

- Large stockholders buy, borrow and die. Meaning deferring income tax as long as possible capturing more gains. The potentially still pay zero income tax as shares are moved into trust funds, or passed to heirs.

The Takeaway

So what's going on?

- Is income tax a wealth transfer tax that penalizes some but not others?

- Is our income even ours? Does the government actually own all wealth transfers and gets to decide how much to keep, and how much to let the transferee receive?

After one thinks about it the realize how ludicrous and illogical the entire system is. it is quite clear that the very wealthy hold tremendous sway as they carve out tax loopholes for themselves.

This system creates absolutely ridiculous scenarios where heirs pay zero tax on estates that would have resulted in massive taxes for all wealth transfers just prior to death.

Small to medium sized business owners and their owners are penalized for attempting to transfer business ownership to employees, while transfer to heirs is tax free. The owner pays 15% typically for selling the shares, then the buyer must pay 24% in taxes typically for every dollar earned to pay off the shares, and very likely more like 32%.. Which actually means the buyer must earn $1.315 to for every $1 needed to pay off the seller, ($1 to seller and 24%($1.315)= $0.315 to Uncle Sam. So Uncles Sam carves out a whopping 47% of this transaction. Yes, Uncle Sam wants the hard working little guy to succeed, LOL. And I almost forgot to mention that the little guy also needs a loan most likely to buy these shares, so there is interest on top of everything else.

(Note: If the buyer happens to be doing better which is pretty typical of high performing managers, their marginal tax rate is more like 32%, so they need to earn an extra $0.47 to get the money for each $1 in shares the are trying to purchase.

It's almost foolish and incredibly stupid for any business owner to transfer business ownership like this, pumping huge dollars into government when they can just pass the whole thing over tax free when they die. See Sam Walton, the Walton family and Walmart for a giant example.

So the entire income tax system skews towards favoring nepotism and potentially transferring wealth to the least meritorious, while penalizing the meritorious, the hard working, smart people making things happen.

Comments

Post a Comment