How Inflation Benefits the Wealthy and Hurts the Poor and Middle Class

The accepted viewpoint. Large companies and the wealthy bear no responsibility for consumer inflation exceeding wage inflation, meaning workers are getting poorer even while fully employed. Remember it's not a zero sum game.

The Contrarian Viewpoint

Big businesses which dominate the economy owned and run by the wealthy front run inflation, a significant portion of inflation is driven by expectations both by businesses and consumers. If businesses believe their costs are going up they raise price to compensate. If things on the sales side are especially good and inflation is hot, they will raise prices even more to be safe and pad profits when they can. Consumers just pay up and eat it with the expectation that things can get worse, and often they have little choice but to buy what they need regardless of price.

While businesses are rapidly raising their prices, they are also working as hard as possible to control their input costs, which means knowingly attempting to keep their pay raises well below their price increases. Raising profits is key, and controlling wage cost increases is a part of that.

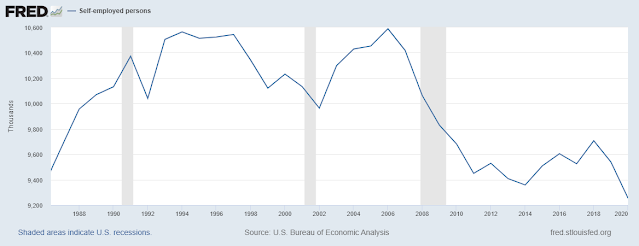

Myself and others often focus on open borders that create an overabundance of labor supply holding down wages, trade deficits that devalue the dollar, treasure money print that devalue the dollar (hidden tax). While neglecting the impact of wealthy individuals on inflation, And completely ignoring that inflation is mostly a zero sum game. The wealthy owners of the resources and means of production and distribution are major beneficiaries while the less you have the more it hurts. Are we to assume massive inflation is just another happy accident for the very wealthy.

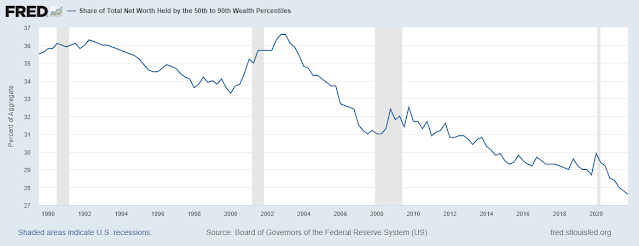

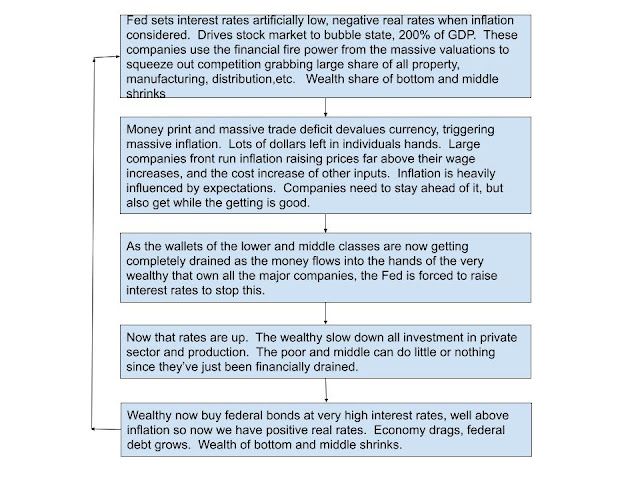

This article explains how the federal government and Federal Reserve Bank work in tandem to pump wealth from the middle class to the top. The lower 50% are also tools in this exercise for the wealthy, but have so little that not much moves up.

Wealth Loss from Middle

Wealth Gain at Top

Basics of Macroeconomic Cycle

Comments

Post a Comment